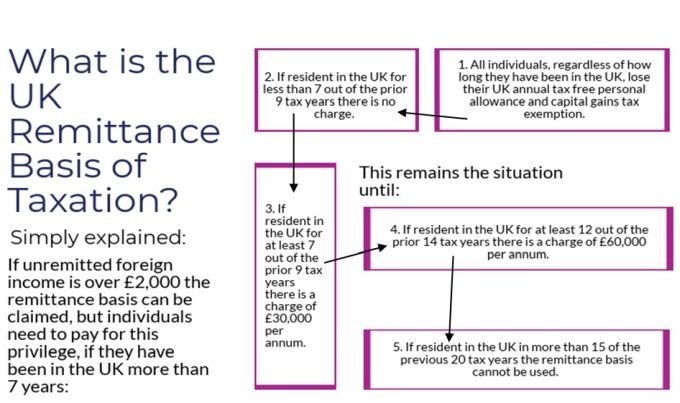

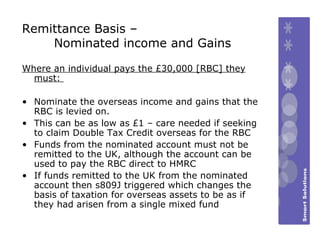

Fenech & Fenech Advocates - Malta operates a remittance basis of taxation for persons who are resident or domiciled in Malta for tax purposes. The Budget Implementation Act (Act VII of 2018),

Malta: Commissioner publishes first ever guideline on remittance basis of taxation | International Tax Review